Usually, as world wide crude oil is priced in dollars,

when the dollar rises in value relative to other world currencies,

gasoline prices decline in the US.

In economies with falling currencies relative to the US dollar,

which looks like most of the rest of the world at this point,

prices rise for products, services and debt priced in US dollars.

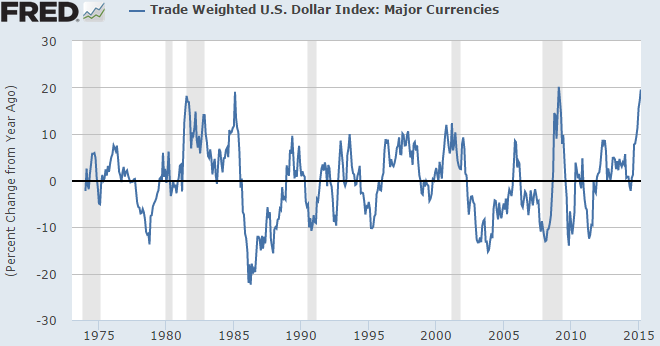

Notice the correlations between a rising US dollar,

to recessions in the graph above.

It takes more local currency to pay for debt when the US dollar rises in value

for companies in Brazil or China who borrowed in US dollars,

who have to convert local currency into US dollars for debt payments.

That's how Zimbabwe's currency collapsed,

as Mugabe just printed the money to convert to US dollars

to repay the IMF.

It's why a bunch of emerging market companies

are freaking out at the moment.

The world is today more dollarized than ever before.

Foreigners have borrowed $9 trillion in US currency

outside American jurisdiction,

...up from $2 trillion in 2000.

The emerging market share - mostly Asian -

has doubled to $4.5 trillion since the Lehman crisis

...The dollar index (DXY) has soared 24pc since July,

and 40pc since mid-2011.

Ambrose Evans-Prichard

March 11, 2015

As the US follows the rest of the world into recession,

the best place to park money is going to be in the US,

as we have the worlds reserve currency.

I have observed the following since the beginning of March, 2015

New Orders

Euro-zone multiples = Bubble

Federal Reserve Electronic Money Printing Didn't Work; PPI Final Demand

China Rail Freight, Year over Year, = Worse than 2008 - 2009

Consumer Goods New Orders

Bull / Bear Ratio

Subprime Loan to Sales Ratio for financed new car sales = Bubble

.

.

The subprime post just about upchucks all over the effort by some local rent seekers to bilk Greensboro's taxpayers out of $22 plus million for water and sewer for an new auto plant.

Auto sales since 2008-2009 have been subsidized by the Federal Reserve.

The economic growth we have experienced for six years has been conjured from bringing future demand forward to the present, and the time when the artificial demand comes to an end is approaching rapidly to already happening.

The world's central banks have kept financial markets humming, instead of organic economic growth.

Artificially imposed stability creates higher levels of future instability.

I believe the era of what was future instability has arrived.

Capital flows are surging into US assets from faltering emerging economies with much more debt than the US. The more "hot" money leaves those economies, the more it will cost to pay off their dollar denominated debt, exacerbating the negative feedback loop already in place.

Prices for imported goods in the US will fall in price, as our exports become more unafordable to the rest of the world, and on and on.