funded by the second phase of a 2005 bond valued at $1.8 million.

How much could Greensboro taxpayers end up paying

to keep Greensboro's Carolina Theater in business

to keep Greensboro's Carolina Theater in business

after we build a new Performing Arts Center?

...The renovation process has been nicknamed "the Face-lift"

...(a previous set of repairs to the HVAC and leaky roof

was nicknamed "the Heart Transplant").

...An additional upgrade, paid for outside of the initial bond,

sees new high-quality digital projectors...

..."It's always a challenge when the revenue stops coming in,

but when you look at the cost of not having this, it more than evens out.

"The city gets a better building, and we get a better place to do business."

Indy Week

.

.

Remember when City Council and the News and Record

said the last cost increase above $65 million was the first?

It wasn't;

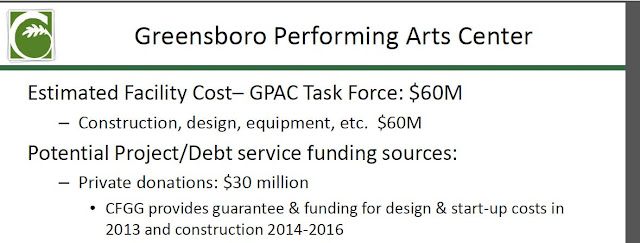

And the City's projections didn't count in how much Walker Sanders' Community Foundation would take from managing the 'endowment' of pledges or interest on the loan the Foundation took out to cover the money which wasn't paid up front, but over a series of years, just like Say Yes to Education's Say Yes Guilford;

Community Foundation Administrative Fee Schedule; "Investment expenses are charged to each fund in addition to the costs..."

http://hartzman.blogspot.com/2013/08/community-foundation-administrative-fee.html

.

.

From what I understand, the Community Foundation has a credit line to borrow about $20 million to pay for STPAC construction etc... which it doesn't have in hand yet

If the Community Foundation keeps the money to manage in risk assets

while using a credit line for GPAC construction and borrows for 5 years;

About $200,000 x 5 years = $1,000,000 to the CFGG

if the assets don't change in value, if they are charging 1%.

Plus the interest on the line of credit,

which if 5%, would be $1 million per year = $5 million

for all of the $20 million borrowed for the whole time,

which supposedly it won't be.

So let's call the interest on the loan at least $2 million

which the News and Record and the Rhino never reported.

Let's not forget the fine folks who self dealed our way into this mess;

David Hagan's return on his $1,000 Robbie Perkins' Contribution; 58,600%, or $586,000

http://hartzman.blogspot.com/2013/10/david-hagans-return-on-his-1000-robbie.html

News & Record Letter to the Editor; David Hagan’s commissions don’t serve taxpayers

http://hartzman.blogspot.com/2013/09/news-record-letter-to-editor-david.html

On US Senator Kay Hagan's Brother in Law David Hagan, Making a Nice Slice off Greensboro's Taxpayers while Sitting on CFGG's Board

http://hartzman.blogspot.com/2013/09/on-us-senator-kay-hagans-brother-in-law.html

.

.

The City of Greensboro's GPAC operating loss pro forma that doesn't include debt service

http://hartzman.blogspot.com/2013/08/the-city-of-greensboros-gpac-operating.html

Two reasons among many that a GPAC with 3,000 seats probably won't work as well as DPAC with 2,700 seats

http://hartzman.blogspot.com/2013/06/one-reason-among-many-that-gpac-with.html

Greensboro City Council Members

are Fiduciaries for Greensboro's taxpayers on the STPAC.

City Council voted to provide taxpayer revenue

to borrow for this project without knowing what they should,

and/or willfully ignored data which would have led to a no vote

and violated their fiduciary duties to their constituents.

.

.

"The fiduciary duty is a legal relationship of confidence or trust between two or more parties. One party…acts in a fiduciary capacity to another, such as one whose funds are entrusted to it. In a fiduciary relation, one person justifiably reposes confidence, good faith, reliance and trust in another whose aid, advice or protection is sought in some matter.

In such a relation, good conscience requires one to act at all times for the sole benefit and interests of another, with loyalty to those interests.

A fiduciary…must not put his personal interests before the duty, and must not profit from his position as a fiduciary, unless the principal consents.

A fiduciary cannot have a conflict of interest.

…A fiduciary must not profit from the fiduciary position.

This includes any benefits or profits which although unrelated to the fiduciary position, came about because of an opportunity that the fiduciary position afforded.

Secret commissions, or bribes also come under the no profit rule.

Conduct by a fiduciary may be deemed constructive fraud, when it is based on acts, omissions or concealments…that gives one an advantage."

Fiduciary

Wikipedia

.

.

Two reasons among many that a GPAC with 3,000 seats

probably won't work as well as DPAC with 2,700 seats;

Add Durham and Raleigh and compare to Greensboro above

Now subtract Durham and Raliegh from Greensboro's average wages;

|

| http://greensboropartnership.com/pdf/stateofcity13.pdf |

BTW, the pro forma sold to the public didn't include debt service;

The City of Greensboro's STPAC operating loss pro forma that doesn't include debt service

.

.

And BTW, DPAC 'profit' doesn't include debt service

which Greensboro's City Council and Roy's Rhino

misled our community about;

DPAC makes $2.5 million profit in third season [The Herald-Sun, Durham, N.C.]

(Herald-Sun (Durham, NC) Via Acquire Media NewsEdge) Aug. 19--DURHAM -- Preliminary returns indicate that the Durham Performing Arts Center turned a $2.5 million profit in fiscal 2010-11, another strong showing derived from the facility's ability to draw crowds from across the region.

The city is in line to receive $1 million of that, thanks to a deal with operator PFM/Nederlander that entitles it to 40 percent of the center's annual net income. Officials put the money into a reserve for maintenance, debt service and building improvements.

Reported to the City Council on Thursday, the numbers were somewhat off the near-$3 million profit the facility recorded in fiscal 2009-10.