Our local media cream themselves

over massively leveraged oligarchs,

siphoning taxpayer funded incentive money

with the help of Greensboro's City Council

...China is integral to the global financial markets, and so its slowdown and capital flight are toppling carry trade and other risk-off financial dominoes.

China is tightly coupled to the U.S. and global economies via capital flows and supply/demand.

If capital flows diminish,

Greensboro may have a tough time

refinancing more than $100 million in short term debt,

especially as Puerto Rico among others

defaults on municipal debt

like the money Nancy Vaughan and friends just chose to borrow by fiat

without a referendum or a public hearing.

But once China's slowdown starts impacting the American economy, the mainstream financial media trundles out the usual pundit suspects to declare that the U.S. and Chinese economies are decoupled...

Just like Greensboro News and Record's Richard Barron

who relatively only interviews and reports

on what sold out economists spew to the majority of dumb-ass locals

most of whom couldn't figure out they have been robbed

by real estate developers and City Council

like Andrew Brod and Obamacare

China has provided marginal demand in everything from iron to oil to machine tools. Now that China's demand is faltering, global demand is weakening and profits are collapsing because China provided the critical marginal demand that fueled immense profits.

Which are now disappearing,

but most who read the News and Record don't know

as they were never informed

This decline in marginal demand is crushing commodity-based economies and triggering recessions as profits, sales and wages all decline.

But the STPAC is now more than $10 more

than we were originally lied to about

as gas and construction costs plummet

...The tidal wave of cash flooding out of China has provided marginal demand for high-priced real estate in Europe and the U.S.

Same wave our local developers have been riding

only in derivative

...Now that trillions of yuan of phantom wealth are disappearing in China, those immense capital flows into Western assets are drying up. A staggering percentage of China's household wealth is tied up in illiquid and overvalued real estate.

Not very unlike Greensboro's

Depending on how much leverage, corruption and wealth has piled up ...this phase may last a few years.

Check

...As the economy weakens, the momentum is to the downside.

Everything that worked...every investor and leader was a genius and could do no wrong--reverses: nothing works any more.

How much money has Marty and Roy borrowed to spend

over the last few years,

and how much are they saying they are going to spend going forward?

Seems almost unbelievable, doesn't it?

...leaders' efforts to reverse the decline are ham-handed failures.

This decline is inevitable in ...economies that play fast and loose with credit/debt and leverage. All the phantom wealth piled up in China's boost phase is now melting down, and ...will trigger a meltdown in global phantom assets."

http://charleshughsmith.blogspot.com/2016/01/the-china-syndrome-coming-global.html

.

.

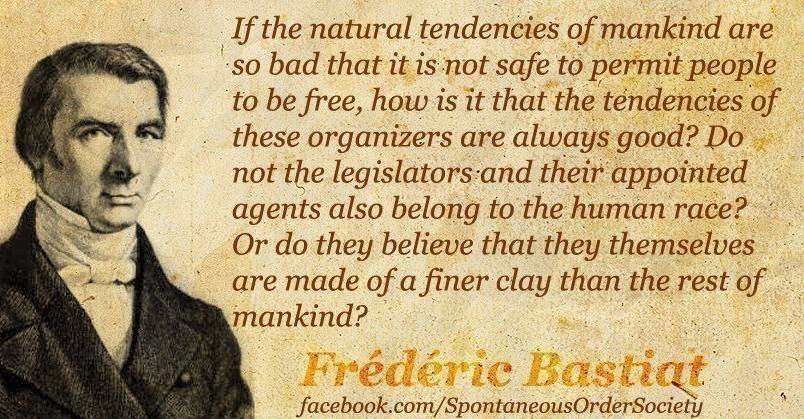

As markets falter, the News and Record has failed to report the contents and descriptions of the investments pledged for the STPAC and Say Yes Guilford, most of which isn't even in hand yet.

|

| http://www.nasdaq.com/symbol/skt/stock-chart?intraday=off&timeframe=3y&splits=off&earnings=off&movingaverage=None&lowerstudy=volume&comparison=off&index=&drilldown=off |

"Naming announcement event!

On September 9, 2013, we announced the name of the center

– the Steven Tanger Center for the Performing Arts

– and Mr. Tanger challenged the community to raise $35 million."

http://tangerperformingarts.com/

.

.

Tanger's stock isn't much higher than 2013 when Steven announced his gift.

Guess where the money is located.

Guess where the rest of the money not yet delivered is located.

What happens if the stock gets cut in half,

along with a majority of the rest of the pledges?

Not one Greensboro City Council member

knows what the monies are invested in to my knowledge.

.

.

"Tanger Factory Outlet Centers, Inc. and subsidiaries is one of the largest owners and operators of outlet centers in the United States and Canada. We are a fully-integrated, self-administered and self-managed REIT, which focuses exclusively on developing, acquiring, owning, operating and managing outlet shopping centers. As of December 31, 2014 , our consolidated portfolio consisted of 36 outlet centers, with a total gross leasable area of approximately 11.3 million square feet. These outlet centers were 98% occupied and contained over 2,400 stores, representing approximately 380 store brands. We also had partial ownership interests in 9 outlet centers totaling approximately 2.6 million square feet, including 4 outlet centers in Canada."

http://secfilings.nasdaq.com/edgar_conv_html%2f2015%2f02%2f24%2f0000899715-15-000062.html#FIS_BUSINESS

.

.

"Total Debt/Equity - 2.90" = 290% of equity

http://www.nasdaq.com/symbol/skt/stock-report

.

.

Debt/Equity Ratio is a debt ratio used to measure a company's financial leverage, calculated by dividing a company’s total liabilities by its stockholders' equity. The D/E ratio indicates how much debt a company is using to finance its assets relative to the amount of value represented in shareholders’ equity.

The formula for calculating D/E ratios can be represented in the following way:

Debt - Equity Ratio = Total Liabilities / Shareholders' Equity

The result may often be expressed as a number or as a percentage.

...the debt/equity ratio measures a company’s debt relative to the total value of its stock, it is most often used to gauge the extent to which a company is taking on debts as a means of leveraging (attempting to increase its value by using borrowed money to fund various projects). A high debt/equity ratio generally means that a company has been aggressive in financing its growth with debt. Aggressive leveraging practices are often associated with high levels of risk. This may result in volatile earnings as a result of the additional interest expense.

For example, suppose a company has a total shareholder value of $180,000 and has $620,000 in liabilities. Its debt/equity ratio is then 3.4444 ($620,000 / $180,000), or 344.44%, indicating that the company has been heavily taking on debt and thus has high risk.

http://www.investopedia.com/terms/d/debtequityratio.asp#ixzz3wz8LB9sD

.

.

Tanger's debt appears to be 290% of the value of the shares outstanding

in a recessionary retail environment

and the News and Record is clueless

as the overwhelming majority of those whose jobs it is to report news

don't understand finance,

and the ones who do, Jeff Gauger for instance,

won't say anything, because if he did he'd lose his job.

.

.

"19 High Yielding Income Growth Stocks With Low Debt Ratios

Boardwalk Pipeline Partners (BWP)...The total debt represents 45.01 percent of the company’s assets and the total debt in relation to the equity amounts to 91.28 percent.

http://www.trefis.com/stock/azn/articles/175801/19-high-yielding-income-growth-stocks-with-low-debt-ratios/2013-03-26

Tanger "Total Debt/Equity - 2.90" = 290% of equity

"Why ONEOK’s Leverage Is a Key Concern for Investors

ONEOK’s (OKE) current debt-to-equity ratio is 2.2x. In comparison, midstream companies Spectra Energy (SE), Enterprise Products Partners (EPD), Enable Midstream Partners (ENBL), and Enbridge Energy Partners (EEP) have debt-to-equity ratios of 1.4x, 1.1x, 0.4x, and 0.8x, respectively.

...Debt-to-EBITDA ratios are often used to assess a company’s ability to repay debt. It’s commonly used by credit rating agencies to determine a company’s credit rating. A lower ratio is considered better.

http://finance.yahoo.com/news/why-oneok-leverage-key-concern-210859372.html;_ylt=AwrC1TFvSZRWe3kAiAXQtDMD;_ylu=X3oDMTByOHZyb21tBGNvbG8DYmYxBHBvcwMxBHZ0aWQDBHNlYwNzcg--

.

.

"RBS tells investors: 'Sell everything'

RBS has advised clients to brace for a "cataclysmic year" and a global deflationary crisis, warning that the major stock markets could fall by a fifth and oil may reach $US16 a barrel.

The bank's credit team said markets are flashing the same stress alerts as they did before the Lehman crisis in 2008.

"Sell everything except high quality bonds. This is about return of capital, not return on capital. In a crowded hall, exit doors are small," it said in a client note.

http://www.smh.com.au/business/markets/rbs-tells-investors-sell-everything-20160111-gm3ssa.html#ixzz3wzBXhHAb

.

.

"...real estate companies usually buy out the entire property, such transactions require large upfront investments, which are quite often funded with a large quantity of debt. One metric that investors pay attention to is the degree of leverage the real estate company has, which is measured by the debt-to-equity (D/E) ratio. In May 2015, the D/E ratio for the real estate sector ranged from 0 to 1,451, and the average was 161.

Tanger "Total Debt/Equity - 2.90" = 290% of equity

http://www.investopedia.com/ask/answers/060215/what-average-debtequity-ratio-real-estate-companies.asp#ixzz3wzCH0BhW

No one knows how leveraged Roy and Marty are,

but if the markets crack,

Greensboro's taxpayers will have been sold a much bigger bridge

than originally anticipated,

and if so, the blame should be placed on Greensboro's finance department

City Council, and CFGG's Walker Sanders among others

as they misled the public, again