"Helicopter money has been proposed as an alternative to Quantitative Easing (QE) when interest rates are close to zero and the economy remains weak or enters recession.

Economists have used the term 'helicopter money' to refer to two very different policies.

The first set of policies emphasizes the 'permanent' monetization of budget deficits.

The second set of policies involves the central bank making direct transfers to the private sector financed with base money, without the direct involvement of fiscal authorities.

This has also been called a citizens' dividend or a distribution of future seigniorage.

The idea was made popular by the American economist Milton Friedman in 1969 and reinforced in contemporary times by former Federal Reserve chairman Ben Bernanke."

https://en.wikipedia.org/wiki/Helicopter_money

.

.

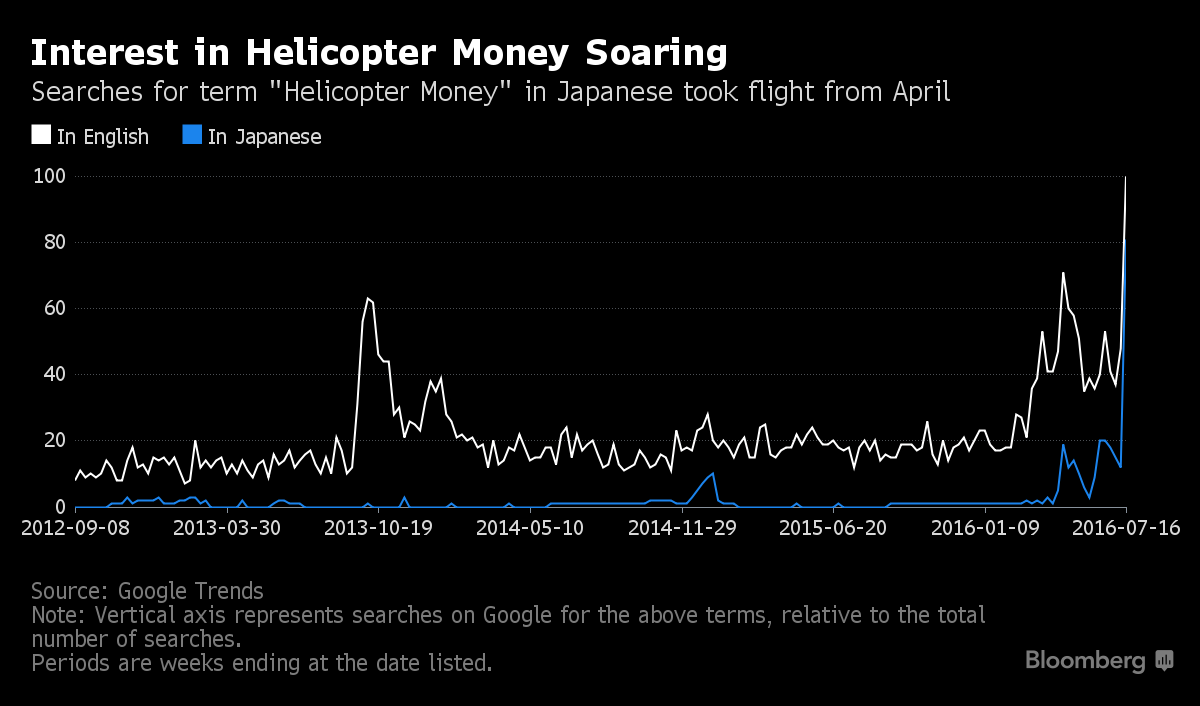

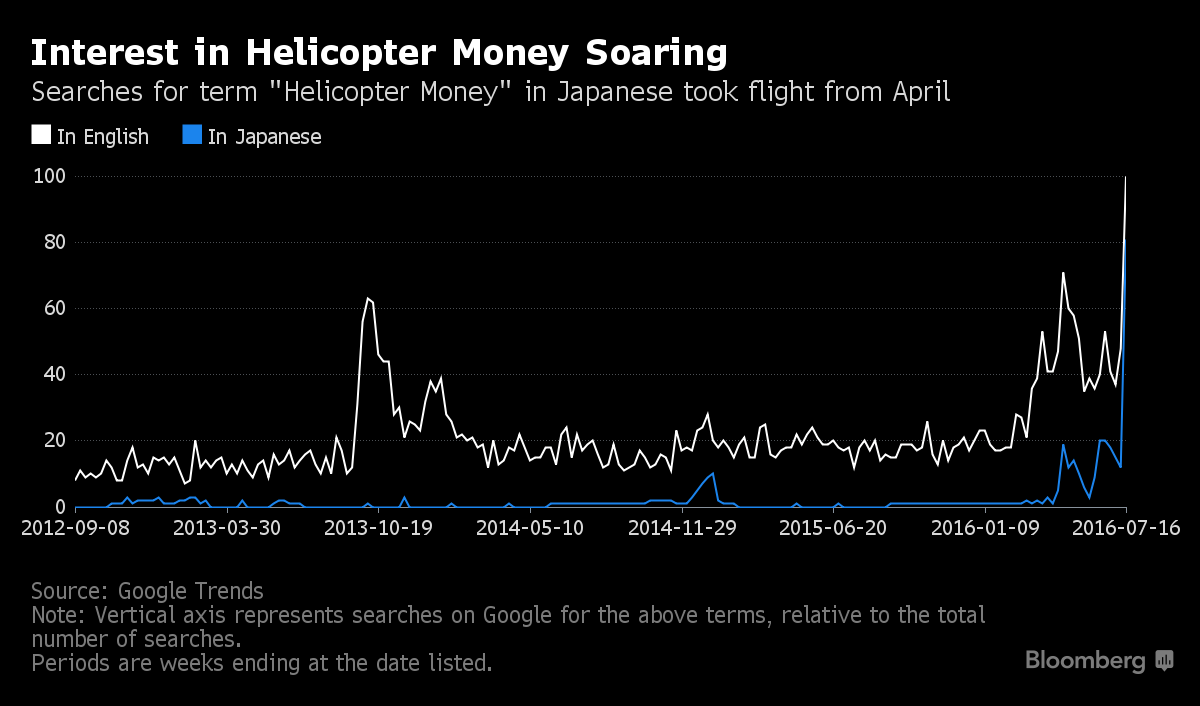

Jul 14, 2016; "Bernanke Floated Japan Perpetual Debt Idea to Abe Aide Honda"

Bernanke, who met Japanese leaders in Tokyo this week,

had floated the idea of perpetual bonds during earlier discussions in Washington

with one of Prime Minister Shinzo Abe’s key advisers.

Abe advisor Etsuro Honda said that during an hour-long discussion with Bernanke in April

the former Federal Reserve chief warned there was a risk

Japan at any time could return to deflation.

He noted that helicopter money could work as the strongest tool to overcome deflation,

according to Honda.

Bernanke noted it was an option.

...Adair Turner, a former head of Britain’s financial regulator, has said it would be useful to make clear to the Japanese people that it’s not necessary that the public debt all be repaid.

"I do not believe that there is any credible scenario in which Japanese government debt can be repaid in the normal sense of the word repay," according to Turner. “It would therefore be useful to make clear to the Japanese people that the public debt does not all have to be repaid, since some of it can be permanently monetized by the Bank of Japan.

Speaking to reporters in Singapore on Thursday, Krugman said that from a strictly economic perspective, helicopter money "adds nothing." But it could have merits from a political economy point of view, he said.

...Amid intense speculation about the chances of helicopter money, and the certainty of further fiscal stimulus ordered by the prime minister, Japanese shares have rallied for four consecutive days while the yen has weakened.”

http://www.bloomberg.com/news/articles/2016-07-14/bernanke-floated-japan-perpetual-bonds-idea-to-abe-adviser-honda

If a nation prints more money,

like cutting a large pizza into 16 slices instead of 8,

is each slice worth less?

What if the pizza shrinks while the number of slices rise?

Why did the Roman Empire reduce currency size and silver content

to increase the quantity of money during war against Hannibal?

Why did the Legal Tender Act of 1862 authorize paper money,

not exchangeable for gold or silver, to finance the Civil War without raising taxes?

If Germany’s central bank suspended the right

to redeem gold backed Reichsmarks during World War I,

and 170 Reichsmarks bought an ounce of gold in January 1919,

why did an ounce of gold cost 87,000,000,000,000 Reichsmarks in November 1923?

Why did John F. Kennedy attempt to bypass the Federal Reserve in 1963

by authorizing silver backed Treasury Certificates?

Why did the US stop exchanging paper dollars for gold and silver in 1971,

after printing more without raising taxes

to pay for Vietnam and socialized benefit programs?

Is current economic growth dependant on increasing debt creation?

If there’s less than $45 billion in Vault Cash,

and 20 million people wanted to withdraw $10,000 each at the same time

from about $6 trillion in savings deposits, where would the $200 billion come from?

If there were $744,000,000,000 US dollars in 1971,

and $10,298,000,000,000 before the Federal Reserve stopped publicly counting,

did America acquire present want and sacrifice future need

by creating an over-abundant currency supply?

If there are at least 15,000 professional American Economists,

and less than 1% foresaw the financial crisis,

should many financial industry and government paid prognosticators

be relied on for honesty concerning national finances?

.

.

James Grant on historical US defaults, and of US defaults present and to come from currency debasement;

"The U.S. government defaulted after the Revolutionary War, and it defaulted at intervals thereafter.

Moreover, on the authority of the chairman of the Federal Reserve Board, the government means to keep right on shirking, dodging or trimming, if not legally defaulting.

...The Federal Reserve can materialize the scrip on a computer screen.

Things were very different when America owed the kind of dollars that couldn’t just be whistled into existence. By 1790, the new republic was in arrears on $11,710,000 in foreign debt. These were obligations payable in gold and silver. Alexander Hamilton, the first secretary of the Treasury, duly paid them. In doing so, he cured a default.

Hamilton’s dollar was defined as a little less than 1/20 of an ounce of gold. So were those of his successors, all the way up to the administration of Franklin D. Roosevelt. But in the whirlwind of the “first hundred days” of the New Deal, the dollar came in for redefinition. The country needed a cheaper and more abundant currency, FDR said. By and by, the dollar’s value was reduced to 1/35 of an ounce of gold.

By any fair definition, this was another default. Creditors both domestic and foreign had lent dollars weighing just what the Founders had said they should weigh. They expected to be repaid in identical money.

...The “American default,” as this piece of domestic stimulus was known in foreign parts , provoked condemnation in the City of London. “One of the most egregious defaults in history,” judged the London Financial News. “...The plea that recent developments have created abnormal circumstances is wholly irrelevant. It was precisely against such circumstances that the gold clause was designed to safeguard bondholders.”

The lighter Roosevelt dollar did service until 1971, when President Richard M. Nixon lightened it again. In fact, Nixon allowed it to float. No longer was the value of the greenback defined in law as a particular weight of gold or silver. It became what it looked like: a piece of paper.

Yet the U.S. government continued to find trusting creditors...

...Sooner or later, the Obama Treasury will resume writing checks.

The question is what those checks will buy.

“Less and less,” is the Federal Reserve’s announced goal. Under Chairman Ben Bernanke (with the full support of the presumptive chairman-to-be, Janet Yellen)...

In other words, the value of money has become an instrument of public policy, not an honest weight or measure.

...The post-1971 dollar derives its value from the stamp of the government that issues it.

...Lend us your dollars for 10 years, the Treasury proposes. ...And at the end of those 10 years, we will hand you back your principal, which will almost certainly buy less than the money you lent.

This is the unsustainable conceit of the world’s superpower-cum-super debtor.

By deed, if not audible word, we Americans say: “The greenback is the world’s great monetary brand. You have no choice but to use it. Like it or lump it.” But the historical record of paper currencies is clear: Governments always over-issue it. The people finally do lump it.

What to do? Let us face facts: We have defaulted in the past. Let us confront the implied message of the Federal Reserve’s pro-inflation policy: We will default in the future, though no lawyer will call it “default.”..."

James Grant

Economists have used the term 'helicopter money' to refer to two very different policies.

The first set of policies emphasizes the 'permanent' monetization of budget deficits.

Monetization of budget deficits

= 'Printing' pretend money to pay for government overspending

out of thin air, because they can for a while longer than so far

The second set of policies involves the central bank making direct transfers to the private sector financed with base money, without the direct involvement of fiscal authorities.

This has also been called a citizens' dividend or a distribution of future seigniorage.

Everybody gets a check,

not from our elected leaders, but a central bank

whose member banks own the central bank in the Fed's case

The idea was made popular by the American economist Milton Friedman in 1969 and reinforced in contemporary times by former Federal Reserve chairman Ben Bernanke."

https://en.wikipedia.org/wiki/Helicopter_money

.

.

Jul 14, 2016; "Bernanke Floated Japan Perpetual Debt Idea to Abe Aide Honda"

Bernanke, who met Japanese leaders in Tokyo this week,

had floated the idea of perpetual bonds during earlier discussions in Washington

with one of Prime Minister Shinzo Abe’s key advisers.

'Perpetual', as in the elimination of the need for repayment = Banana Republic

Abe advisor Etsuro Honda said that during an hour-long discussion with Bernanke in April

the former Federal Reserve chief warned there was a risk

Japan at any time could return to deflation.

He noted that helicopter money could work as the strongest tool to overcome deflation,

according to Honda.

Bernanke noted it was an option.

...Adair Turner, a former head of Britain’s financial regulator, has said it would be useful to make clear to the Japanese people that it’s not necessary that the public debt all be repaid.

WTF?

"I do not believe that there is any credible scenario in which Japanese government debt can be repaid in the normal sense of the word repay," according to Turner. “It would therefore be useful to make clear to the Japanese people that the public debt does not all have to be repaid, since some of it can be permanently monetized by the Bank of Japan.

All the way up to 0, but slowly

Speaking to reporters in Singapore on Thursday, Krugman said that from a strictly economic perspective, helicopter money "adds nothing." But it could have merits from a political economy point of view, he said.

...Amid intense speculation about the chances of helicopter money, and the certainty of further fiscal stimulus ordered by the prime minister, Japanese shares have rallied for four consecutive days while the yen has weakened.”

No shit

http://www.bloomberg.com/news/articles/2016-07-14/bernanke-floated-japan-perpetual-bonds-idea-to-abe-adviser-honda

If a nation prints more money,

like cutting a large pizza into 16 slices instead of 8,

is each slice worth less?

What if the pizza shrinks while the number of slices rise?

Why did the Roman Empire reduce currency size and silver content

to increase the quantity of money during war against Hannibal?

Why did the Legal Tender Act of 1862 authorize paper money,

not exchangeable for gold or silver, to finance the Civil War without raising taxes?

If Germany’s central bank suspended the right

to redeem gold backed Reichsmarks during World War I,

and 170 Reichsmarks bought an ounce of gold in January 1919,

why did an ounce of gold cost 87,000,000,000,000 Reichsmarks in November 1923?

Why did John F. Kennedy attempt to bypass the Federal Reserve in 1963

by authorizing silver backed Treasury Certificates?

Why did the US stop exchanging paper dollars for gold and silver in 1971,

after printing more without raising taxes

to pay for Vietnam and socialized benefit programs?

Is current economic growth dependant on increasing debt creation?

If there’s less than $45 billion in Vault Cash,

and 20 million people wanted to withdraw $10,000 each at the same time

from about $6 trillion in savings deposits, where would the $200 billion come from?

If there were $744,000,000,000 US dollars in 1971,

and $10,298,000,000,000 before the Federal Reserve stopped publicly counting,

did America acquire present want and sacrifice future need

by creating an over-abundant currency supply?

If there are at least 15,000 professional American Economists,

and less than 1% foresaw the financial crisis,

should many financial industry and government paid prognosticators

be relied on for honesty concerning national finances?

.

.

James Grant on historical US defaults, and of US defaults present and to come from currency debasement;

"The U.S. government defaulted after the Revolutionary War, and it defaulted at intervals thereafter.

Moreover, on the authority of the chairman of the Federal Reserve Board, the government means to keep right on shirking, dodging or trimming, if not legally defaulting.

...The Federal Reserve can materialize the scrip on a computer screen.

Things were very different when America owed the kind of dollars that couldn’t just be whistled into existence. By 1790, the new republic was in arrears on $11,710,000 in foreign debt. These were obligations payable in gold and silver. Alexander Hamilton, the first secretary of the Treasury, duly paid them. In doing so, he cured a default.

Hamilton’s dollar was defined as a little less than 1/20 of an ounce of gold. So were those of his successors, all the way up to the administration of Franklin D. Roosevelt. But in the whirlwind of the “first hundred days” of the New Deal, the dollar came in for redefinition. The country needed a cheaper and more abundant currency, FDR said. By and by, the dollar’s value was reduced to 1/35 of an ounce of gold.

By any fair definition, this was another default. Creditors both domestic and foreign had lent dollars weighing just what the Founders had said they should weigh. They expected to be repaid in identical money.

...The “American default,” as this piece of domestic stimulus was known in foreign parts , provoked condemnation in the City of London. “One of the most egregious defaults in history,” judged the London Financial News. “...The plea that recent developments have created abnormal circumstances is wholly irrelevant. It was precisely against such circumstances that the gold clause was designed to safeguard bondholders.”

The lighter Roosevelt dollar did service until 1971, when President Richard M. Nixon lightened it again. In fact, Nixon allowed it to float. No longer was the value of the greenback defined in law as a particular weight of gold or silver. It became what it looked like: a piece of paper.

Yet the U.S. government continued to find trusting creditors...

...Sooner or later, the Obama Treasury will resume writing checks.

The question is what those checks will buy.

“Less and less,” is the Federal Reserve’s announced goal. Under Chairman Ben Bernanke (with the full support of the presumptive chairman-to-be, Janet Yellen)...

In other words, the value of money has become an instrument of public policy, not an honest weight or measure.

...The post-1971 dollar derives its value from the stamp of the government that issues it.

...Lend us your dollars for 10 years, the Treasury proposes. ...And at the end of those 10 years, we will hand you back your principal, which will almost certainly buy less than the money you lent.

This is the unsustainable conceit of the world’s superpower-cum-super debtor.

By deed, if not audible word, we Americans say: “The greenback is the world’s great monetary brand. You have no choice but to use it. Like it or lump it.” But the historical record of paper currencies is clear: Governments always over-issue it. The people finally do lump it.

What to do? Let us face facts: We have defaulted in the past. Let us confront the implied message of the Federal Reserve’s pro-inflation policy: We will default in the future, though no lawyer will call it “default.”..."

James Grant