In 1999, after working at J. C. Bradford on the corner of Elm and Cornwallis in Greensboro, North Carolina, George Hartzman, the son a Phd. Nuclear Engineer who taught him what a normal Price to Earnings ratio was supposed to be for a publicly traded stock, found the US financial markets way out of whack.

Hartzman got recruited by IJL/Wachovia in early 2001, which later became Wells Fargo.

On 3/13/2007, Hartzman purchased shares of SDS in his personal account. SDS is a leveraged inverse Exchange Traded Fund (ETF), whose objective is to rise 2% for every 1% the S&P 500 falls. In the fourth quarter of 2008 he sold SDS in two blocks, realizing a total gain of about 51%.

To “Short” is to invest, usually as a hedge, to profit when other “long” or traditional investments, like shares in the stock market fall.

In July, 2007, he shorted Bear Stearns and closed the position with a 97% profit on 3/7/2008. He shorted Pulte Homes, KB Homes and Lennar, and realized about a 65% gain. During 2008, he executed short trades in Goldman Sachs, Capital One, MBIA, Merrill Lynch, Moody’s and State Street Corporation, as well as buying and selling inverse ETF’s covering financials and real estate.

The solid blue lines on the performance report charts, which are now public records, show how much more these clients made and\or lost compared to the dotted lines below which represent selected indices at the time;

He was one of the only advisors at Wells Fargo who did well in the downturn.

Many of his clients entered into many similar trades at relatively the same time as the account performance reports show, which illustrate some of the best un-audited Asset Advisor performance reports in his book of business as of June, 2010.

Hartzman began working as a financial advisor in 1993 and taught CPA and attorney financial ethics in North Carolina for 10 years.

On 3/31/2009, total assets under management in Aenbr's book of business was $35,595,572.83, including both fiduciary and non fiduciary accounts. He had more than 60 Asset Advisor accounts, where financial advisers are legally obligated to act in the best interest of clients.

These accounts were governed by the Investment Advisers Act of 1940, which requires stock brokers be held to fiduciary standards for advisory accounts, requiring financial advisers to act solely in the best interest of their clients.

Advisers must disclose any conflict, or potential conflict to their clients prior to and during a business engagement.

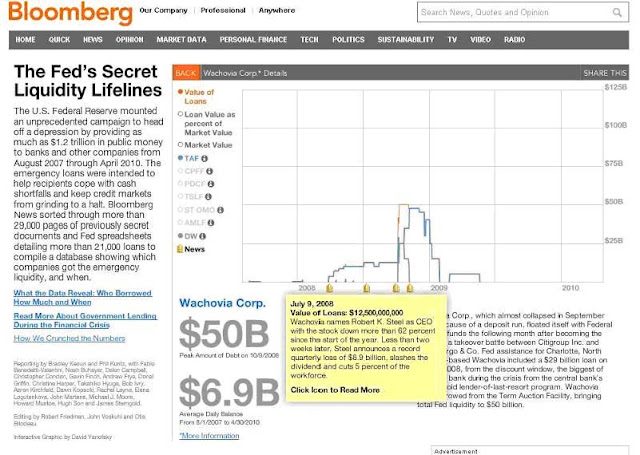

Both Wachovia and Wells Fargo borrowed from the Federal Reserve's Term Auction Facility (TAF), whose loans were not disclosed to the public until December 1, 2010, subsequent to congressionally mandated legislation and civil legal action.

Wachovia, Wells Fargo, KPMG, the Securities and Exchange Commission (SEC), The Financial Industry Regulatory Authority (FINRA) and the Federal Reserve amongst others illegally misled Wachovia’s shareholders. Hartzman disseminated inaccurate advice to clients whose accounts were governed by the Investment Advisors Act of 1940, based on information audited by KPMG and withheld by Wachovia and Wells Fargo’s executive management. His clients and Wachovia shareholders lost or could have made more as insiders profited from material undisclosed information.

According to Bloomberg News, on March 27, 2008, Wachovia borrowed $3.5 billion from the Federal Reserve’s Term Auction Facility (TAF) which was not disclosed to the firm’s shareholders and not reported in the company’s legally required SEC securities filings.

Bloomberg compiled and reported “21,000 transactions” from 2008 and 2009, ...obtained under the Freedom of Information Act” from the Federal Reserve, on August 22, 2011, including undisclosed loans to Wachovia and Wells Fargo amongst others which appears to include BB&T and Ally Financial, formerly GMAC.

Not reporting Federal Reserve material borrowings, credit lines, terms and interest rates is a violation of Sarbanes/Oxley laws, and not informing employees who managed advisory accounts was a violation of fiduciary duties described in the Investment Advisers Act of 1940.

KPMG was/is the auditor for both Wachovia and Wells Fargo.

On July 22, 2008, Wachovia’s new CEO Robert Steel purchased 1,000,000 shares of Wachovia’s stock as the company’s TAF borrowing reached $12.5 billion, which appears not to have been disclosed in securities filings.

If Mr. Steel was “the principal adviser…on matters of domestic finance and led the [U.S. Treasury] department's activities regarding the U.S. financial system, fiscal policy and operations” before becoming Wachovia’s CEO in July, 2008, how could he not have known and acted on undisclosed material information?

Mr. Steel was at least aware of Wachovia’s Federal Reserve loans since July, 2012, if not undisclosed loans to multiples of other firms.

The Federal Reserve approved Wachovia’s merger with Wells Fargo on October 12, knowing of unreported Fed loans to both companies.

Wells Fargo's purchase of Wachovia closed on December 31, 2008. The Wall Street Journal reported "about $100 billion in wealth disappeared from the Carolinas alone when Wachovia collapsed."

Wachovia’s shareholders were misled by Wachovia and Wells Fargo’s management, KPMG, and at least the Federal Reserve and the U.S. Treasury Department. The Sarbanes-Oxley Act of 2002, which he have taught in ethics courses for CPAs and others over the last 10 years, requires executive officers and directors to personally attest that SEC securities filings have been personally reviewed and financial statements fairly present, in all material respects, a company’s financial condition.

Financial information in press releases or other public disclosures must not “contain an untrue statement” or omit a statement of material fact necessary to make statements not misleading.

Wachovia price on date of completed merger with Wells: 12/31/2008 - Last Trade: 5.54

As of January 31, 2008, there were 1,981,983,990 Wachovia shares outstanding.

27.07 - 5.54 = 21.53 x 1,981,983,990 = $42,672,115,304.70 Wachovia market capitalization lost between the first undisclosed TAF loan and Wells merger.

After most of Wachovia’s shareholders were locked into losses on completion of the merger, Mr. Steel ended up far better off knowing what most didn’t. On June 22, 2010, Robert Steel was appointed Deputy Mayor for Economic Development by New York City Mayor Michael Bloomberg. According to Morningstar data, Mr. Steel owned 601,903 shares of Wells Fargo in 2010, which would be worth $20,446,644.91 as of October 26, 2012.

The CEOs and CFOs of America’s largest banks certified their reports didn’t contain any material misstatements or omissions. External auditors attested to the assessments.

Some banks which received Federal Reserve loans disclosed details in their securities filings, like Union Bank & Trust and Peoples Bank of North Carolina.

Wachovia’s, Wells Fargo’s and multiples of other firm's securities filings did not account for the loans, total credit lines, interest rates, collateral pledged or amounts of loans outstanding as other banks did.

Wachovia shareholders lost money as a select few profited from material insider information illegally provided, enabled and consented to by US taxpayer funded government regulatory authorities, elected officials, political appointees and employees.

Bloomberg estimated the profits from the undisclosed Federal Reserve Loans was $878.2 million for Wells Fargo, and $149.4 million for Wachovia.