"...it as a sign of the inflationary times, an effect of worldwide money creation coordinated by the leading central banks, with Toblerone being just one of many victims.

...Since inflation is always and everywhere a monetary phenomenon, and since the world’s central banks have been pumping new money into the global economy at unprecedented rates for several years, we should expect an upward pressure on prices.

In a Facebook post, Toblerone explained ..."We chose to change the shape to keep the product affordable for our customers..."

Statements such as this cause Toblerone to become, unwittingly, a case study for how firms in competitive markets respond when monetary inflation raises their costs of production.

When that happens, firms are less able to pass the cost on to consumers in the form of higher prices because if they do, they face a strong likelihood of losing market share and revenues. Instead, these firms cut back in terms of volume, size, and portions.

...Have you been to a restaurant lately where the menu prices haven’t seemed to change but the portions of food on your plate has?

Or opened a bag of chips that hasn’t fallen in size while the volume of chips inside has?

Or consumed a product of lower quality than you remembered in less inflationary times because its producer was obligated to change ingredients to break even?

...wouldn’t it be great if Toblerone turned this incident into a teaching moment for its devoted customers? If it used its social media channels to remind them of the virtues of hard money and the costs of fiat money?

...It was rare but not uncommon for firms to make such arguments during the inflationary 1970s. It would be even more satisfying than good Swiss chocolate to see it again."

https://mises.org/blog/how-inflation-ruined-chocolate-bar

There are more than 1.2 billion people in India, and the government messed up their money

http://greensboroperformingarts.blogspot.com/2016/11/there-are-more-than-12-billion-people.html

When the US dollar goes up, the price of oil goes down, as oil is priced in US dollars...

http://greensboroperformingarts.blogspot.com/2016/11/when-us-dollar-goes-up-price-of-oil.html

Can stability destabilize?

http://greensboroperformingarts.blogspot.com/2016/11/can-stability-destabilize.html

Excerpt excerpt of what our future holds

http://greensboroperformingarts.blogspot.com/2016/10/excerpt-excerpt-of-what-our-future-holds.html

The Taylor rule and how out of whack the Federal Reserve made our economy

http://greensboroperformingarts.blogspot.com/2016/10/the-taylor-rule-and-how-out-of-whack.html

Money from nothing; "ECB's QE bond buying hits €1 trillion milestone"

http://greensboroperformingarts.blogspot.com/2016/09/money-from-nothing-ecbs-qe-bond-buying.html

"...The US is spiraling down into financial, economic and political collapse...,"

http://greensboroperformingarts.blogspot.com/2016/08/the-us-is-spiraling-down-into-financial.html

"Helicopter money" = Default

http://greensboroperformingarts.blogspot.com/2016/07/helicopter-money-default.html

Justin King; "We are now in the fourth stage of the cycle of insurgency"

http://greensboroperformingarts.blogspot.com/2016/07/justin-king-we-are-now-in-fourth-stage.html

"We are heading for a crisis that will be exponentially worse than 2008"

http://greensboroperformingarts.blogspot.com/2016/06/we-are-heading-for-crisis-that-will-be.html

"The Keynesians Stole The Jobs"

http://greensboroperformingarts.blogspot.com/2016/06/the-keynesians-hillary-clinton.html

"World faces wave of epic debt defaults, fears central bank veteran"

http://greensboroperformingarts.blogspot.com/2016/01/world-faces-wave-of-epic-debt-defaults.html

Yes, this will reverberate in the Piedmont Triad

http://greensboroperformingarts.blogspot.com/2016/01/yes-this-will-reverberate-in-piedmont.html

The only way a system that looks like this could be kept running is by issuing more debt.

http://greensboroperformingarts.blogspot.com/2015/11/the-only-way-system-that-looks-like.html

Martenson, Smith, Noland and Reid and Janszen on the popping bubble that will transform Greensboro and North Carolina's near term future

http://greensboroperformingarts.blogspot.com/2015/10/martenson-smith-noland-and-reid-and.html

There is no amount of cheerleading that can change the outcome,

as it's already set up to get economically worse

...Since inflation is always and everywhere a monetary phenomenon, and since the world’s central banks have been pumping new money into the global economy at unprecedented rates for several years, we should expect an upward pressure on prices.

In a Facebook post, Toblerone explained ..."We chose to change the shape to keep the product affordable for our customers..."

Statements such as this cause Toblerone to become, unwittingly, a case study for how firms in competitive markets respond when monetary inflation raises their costs of production.

More American manufacturing jobs are going to cause price inflation,

making what we want more expensive to purchase

Great idea, but the cheap shit we get from China

would have to disapear off the store shelves,

making already inflation shrinking paychecks go even less far

When that happens, firms are less able to pass the cost on to consumers in the form of higher prices because if they do, they face a strong likelihood of losing market share and revenues. Instead, these firms cut back in terms of volume, size, and portions.

Less for the same price, is more money for less stuff

...Have you been to a restaurant lately where the menu prices haven’t seemed to change but the portions of food on your plate has?

Absolutely

Or opened a bag of chips that hasn’t fallen in size while the volume of chips inside has?

Or consumed a product of lower quality than you remembered in less inflationary times because its producer was obligated to change ingredients to break even?

...wouldn’t it be great if Toblerone turned this incident into a teaching moment for its devoted customers? If it used its social media channels to remind them of the virtues of hard money and the costs of fiat money?

The more pretend money, the higher the prices,

the less product bought, the more expensive x may be the next day

But it doesn't look that way for the US yet,

as the dollar rises in response to all the other central banks print faster

...It was rare but not uncommon for firms to make such arguments during the inflationary 1970s. It would be even more satisfying than good Swiss chocolate to see it again."

https://mises.org/blog/how-inflation-ruined-chocolate-bar

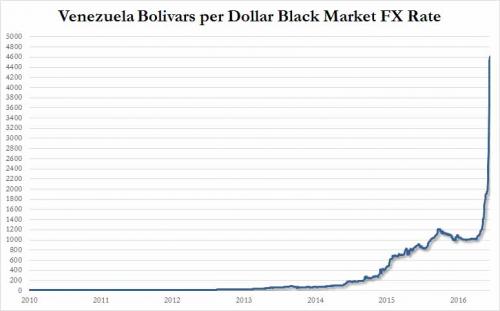

How much do you think a Toblerone costs in Venezuela?

http://greensboroperformingarts.blogspot.com/2016/11/there-are-more-than-12-billion-people.html

When the US dollar goes up, the price of oil goes down, as oil is priced in US dollars...

http://greensboroperformingarts.blogspot.com/2016/11/when-us-dollar-goes-up-price-of-oil.html

Can stability destabilize?

http://greensboroperformingarts.blogspot.com/2016/11/can-stability-destabilize.html

Excerpt excerpt of what our future holds

http://greensboroperformingarts.blogspot.com/2016/10/excerpt-excerpt-of-what-our-future-holds.html

The Taylor rule and how out of whack the Federal Reserve made our economy

http://greensboroperformingarts.blogspot.com/2016/10/the-taylor-rule-and-how-out-of-whack.html

Money from nothing; "ECB's QE bond buying hits €1 trillion milestone"

http://greensboroperformingarts.blogspot.com/2016/09/money-from-nothing-ecbs-qe-bond-buying.html

"...The US is spiraling down into financial, economic and political collapse...,"

http://greensboroperformingarts.blogspot.com/2016/08/the-us-is-spiraling-down-into-financial.html

"Helicopter money" = Default

http://greensboroperformingarts.blogspot.com/2016/07/helicopter-money-default.html

Justin King; "We are now in the fourth stage of the cycle of insurgency"

http://greensboroperformingarts.blogspot.com/2016/07/justin-king-we-are-now-in-fourth-stage.html

"We are heading for a crisis that will be exponentially worse than 2008"

http://greensboroperformingarts.blogspot.com/2016/06/we-are-heading-for-crisis-that-will-be.html

"The Keynesians Stole The Jobs"

http://greensboroperformingarts.blogspot.com/2016/06/the-keynesians-hillary-clinton.html

"World faces wave of epic debt defaults, fears central bank veteran"

http://greensboroperformingarts.blogspot.com/2016/01/world-faces-wave-of-epic-debt-defaults.html

Yes, this will reverberate in the Piedmont Triad

http://greensboroperformingarts.blogspot.com/2016/01/yes-this-will-reverberate-in-piedmont.html

The only way a system that looks like this could be kept running is by issuing more debt.

http://greensboroperformingarts.blogspot.com/2015/11/the-only-way-system-that-looks-like.html

Martenson, Smith, Noland and Reid and Janszen on the popping bubble that will transform Greensboro and North Carolina's near term future

http://greensboroperformingarts.blogspot.com/2015/10/martenson-smith-noland-and-reid-and.html

Billy Jones wins public records lawsuit against the City of Greensboro #ncpol #ncga #gso #gsopol #foia https://t.co/kdRH21JLE5— Abner Doon (@ghartzman) November 30, 2016

From conversations I've had with non-journalists since Nov. 8, the press is under-estimating the blow to trust from a prediction gone wrong.— Jay Rosen (@jayrosen_nyu) November 29, 2016

"When a man corrupted his mind to things he does not believe, he has prepared himself for the commission of every other crime.— Abner Doon (@ghartzman) November 28, 2016

Thomas Paine

"In politics, nothing happens by accident.— Abner Doon (@ghartzman) November 28, 2016

If it happens, you can bet it was planned that way."

Franklin D. Roosevelt

"Thrifty U.S. consumers [left] retailers with less in their registers and a lukewarm kickoff to the holiday season." https://t.co/ZWOgDdDrsp— Abner Doon (@ghartzman) November 28, 2016

@FedPorn @BastiatKnew I'm bidding on $5,000,000,000,000 Zimbabwe dollars right now. If I win they are going in my Xmas cards this year.— Tom Gartner (@TomGartner) November 28, 2016

Chinese investors also getting into more obscure commodities...like garlic. Garlic bulb prices surged to a record high, up more than 80% y/y pic.twitter.com/TiRB7nA1Co— Haidi Lun 伦海迪 (@HaidiLun) November 28, 2016

transactions fell 7.9 percent https://t.co/6m2tpcodAk— Abner Doon (@ghartzman) November 28, 2016

#Bolivia Declares State of Emergency With Worst #Drought in 25 Years https://t.co/iJi0mfClMc #climatechange pic.twitter.com/XZNA41Guzr— Truthdig (@Truthdig) November 27, 2016

I do believe that where there is a choice only between cowardice and violence, I would advise violence. - Mohandas Karamchand Gandhi— Famous-Quote.net (@famousquotenet) November 26, 2016

Bank of #Japan fails to stimulate #inflation. Japan stuck in #deflation for an 8th mth despite totally mad balance sheet expansion. pic.twitter.com/r3ny9Yd6To— Holger Zschaepitz (@Schuldensuehner) November 25, 2016

On Monday, Venezuela's biggest bill bought you four pennies. Today it will only buy three. The bolivar has lost 1/4th of its value in 4 days pic.twitter.com/QHF8oiT5vt— Nathan Crooks (@nmcrooks) November 25, 2016

An investor who bought TLT @ 140 just lost about 14% https://t.co/GmMbzPnzTA— Abner Doon (@ghartzman) November 25, 2016

Thank you https://t.co/m0K45T9Oyc readers; 1,100,456 Pageviews https://t.co/6XwTvDR09R— Abner Doon (@ghartzman) November 24, 2016